It’s not uncommon for landlords and tenants to run into issues over the course of a tenancy, and particularly at the end of a lease. A tenant vacating a property sets in motion responsibilities and requirements for both parties and failing to fulfill those duties on the part of one party can cause recriminations from the other, and quite possibly lead to potential legal action.

Regardless of your feelings about your landlord or tenant, no one wants to get dragged into a protracted dispute. Therefore, it’s important to understand the potential issues that can come up when a tenant moves out, in order to avoid those conflicts and additional stress.

Issues Landlords Might Face

As a landlord, you’ve hopefully stayed on top of any potential issues with your rental unit and tenant over the course of the lease, making repairs as needed and checking in on the property without violating your tenant’s privacy. But there’s always the possibility for things to go wrong at the end despite best efforts.

Damage to the rental property. It can be hard to tell the exact state of a rental unit until after a tenant is fully moved out and the walls, floors, and fixtures are bare. And while most renters are typically responsible and respectful of the property, it may be the case that you’re dealing with considerable damage to the unit that requires repair before you can hope to rent it again. In the case of unreported significant damage, you may consider taking legal action against your former tenant to recoup the cost of those repairs provided that the expenses are beyond what can be covered by the security deposit.

It’s important to note that significant damage is different from the normal wear and tear that comes with living in a place over a period of time. While you’re within your rights to withhold a security deposit for the former, you likely don’t want to get in a fight trying to force a tenant to pay for the latter out of that same deposit.

Insufficient notice to vacate or an illegal move out. As a landlord, you must be able to plan for how and when you’re going to rent out your unit in the event of a tenant moving out. Moreover, you’re likely relying upon the rental income for the full period of the lease in order to cover your own costs. Both your planning and revenue are threatened in the event your tenant decides to pack up and leave without proper warning. If your tenant fails to provide the necessary notice to move out, you may consider legal options for recovering the rent owed for the remaining lease period.

Failing to pay rent. Coupled with the last issue is the possibility that your tenant fails to pay rent on their way out the door. It could be the case that the tenant has failed to pay rent for the past month and has moved out rather than paying that back rent, or perhaps has several months where the rent is late or not paid in full and is looking to avoid paying that as well. If the tenant is still in the property you can begin the eviction process, but if the tenant has chosen to vacate rather than pay, you may be able to go to court to try and recover that unpaid rent.

Issues Renters Might Face

It’s not exclusively the case that tenants are the problem in any dispute. Any renter can tell you that there are bad landlords that fail to uphold their end of the agreement, during the term of the lease and at its end.

Failing to return a security deposit. One of the more common issues renters face is failure on the part of a landlord to return their security deposit in a timely manner, in part or in full. The reasons for the failure can be claims of property damage, above and beyond normal wear or tear, or it could simply be an unwillingness to act in a timeframe prescribed by state law for the return of the deposit.

If your former landlord is failing to return your deposit for a reason you believe is unfair, you may be able to take legal action to try to recover the money. Sometimes, the mere implication of legal action by a lawyer may be enough to prompt them to return your deposit. It’s also smart to document the condition of your rental unit upon moving out for support against any landlord claims of excessive damage.

Improper notice to vacate. It may be the case that your lease permits your landlord to force you to vacate the property in the event of a sale, even if you’ve been a model tenant. There may be state or local laws that cover the notice period, or it may be a specific clause in your lease. And while there’s nothing you can do about the sale, provided that the lease has a clause or there is an ordinance, you can force your landlord to follow the letter of the law. For example, if your landlord is forcing you out in two weeks when you should have a full month or longer to find a new place, you may wish to connect with a lawyer who can assist you so your landlord honors the original timeframe.

How to Resolve Landlord/Tenant Issues

It’s unlikely that your landlord/tenant relationship will be perfect; things around the house or apartment break; money troubles that delay rent payments happen; and other circumstances tend to arise even with the best intentions. Often the best preventative measure for landlord/tenant issues is an open line of communication: by letting the other party know the problem, you can hopefully work together on a resolution. At the very least, good communication will prevent the other party from being blindsided, hopefully making them less inclined to take your issues to court.

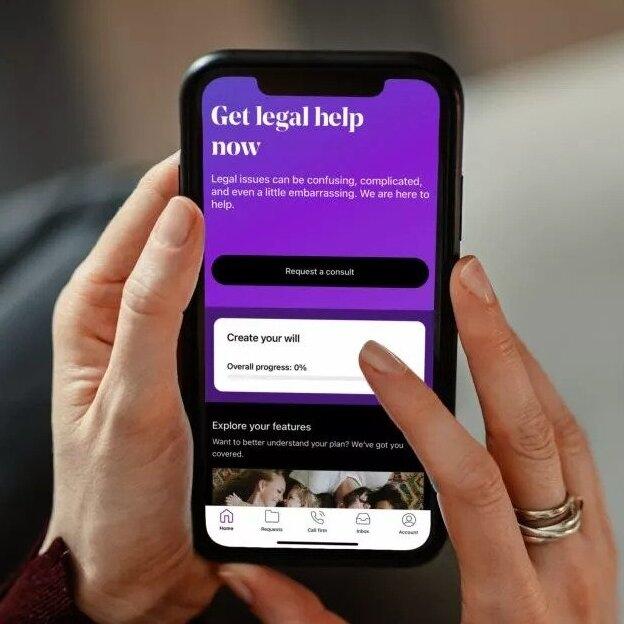

If you do have to consider legal action against a landlord or tenant, it’s important to have professional help on your side. With LegalShield, you can have a lawyer send a letter on your behalf addressing your legal rights, in addition to phone consultations to discuss the best course of action for your issue. Plans start at only $29.95 a month.

Pre-Paid Legal Services, Inc. (“PPLSI”) provides access to legal services offered by a network of provider law firms to PPLSI members through membership-based participation. Neither PPLSI nor its officers, employees or sales associates directly or indirectly provide legal services, representation, or advice. The information available in this blog is meant to provide general information and is not intended to provide legal advice, render an opinion, or provide any specific recommendations. The blog post is not a substitute for competent legal counsel from a licensed professional lawyer in the state or province where your legal issues exist and the reader is strongly encouraged to seek legal counsel for your specific legal matter. Information contained in the blog may be provided by authors who could be a third-party paid contributor. All information by authors is accepted in good faith, however, PPLSI makes no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

Renter or Landlord Questions? Get Legal Help Now!